Book a Business Funding Appointment with

LUXU Solutions

INTRODUCING

The Financial Freedom Plan

$100k-$5M Business Funding

The #1 Grant Funded Business Fund Plan

100% Fundable Business - $2500 Shelf Corp.

Here's what you get:

$100k-$5 Million in Funding

Free Grant Funding

Free Credit Repair

Future Business Funds Support

Credit Repair: $250.00

Credit Repair FREE w/ Any $2500 Shelf Corp.

"IN BUSINESS"

"My business idea was great, but it was a start up with no doc's, LuXu got me 250k same day and 50k in revolving credit, with one $2500 Shelf Corp." - David Young

STILL NOT SURE?

Frequently Asked Questions

What is a Shelf Corporation and Why Use One?

What is a Shelf Corporation?

A shelf corporation (also called an “aged corporation”) is a business entity that was created in the past but has never conducted any operations. It has been “sitting on the shelf” — legally formed, maintained in good standing, and aging over time — but without activity or debt. Lenders and investors often view older businesses as more credible, stable, and fundable compared to brand-new startups.

Why Use A Shelf Corporation?

By purchasing a shelf corporation, you instantly acquire a company with established history, making it easier to qualify for business funding, lines of credit, government contracts, and vendor accounts. At Luxu Solutions, we use shelf corporations to help entrepreneurs, startups, and expanding businesses fast-track the credibility and profile that lenders require — without waiting years to build it organically. This strategy can open the door to $100K–$5M in capital when paired with a strong business credit profile, revenue history, and collateral options.

Who Should Consider Buying a Shelf Corporation?

A shelf corporation is ideal for entrepreneurs and business owners who are ready to secure significant funding but don’t yet meet the strict requirements of traditional lending. This includes startups needing instant credibility, growing businesses that want to separate funding from personal credit, and established entrepreneurs launching new ventures.

When is the best time to use a Shelf Corporation?

Shelf corporations work best when you’re at the stage of business planning where your concept, goals, and revenue model are already defined — but you need aged business history to open doors with lenders, vendors, and partners. At Luxu Solutions, we recommend them for clients who have a clear plan to scale and can quickly leverage the enhanced credibility, faster funding approvals, and access to larger credit lines that come with a seasoned business entity.

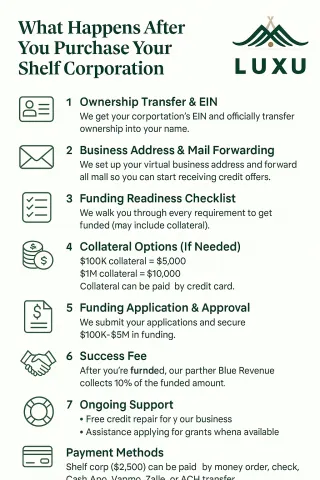

What Happens After You Purchase Your Shelf Corporation?

When you purchase a shelf corporation from Luxu Solutions for $2,500, we handle the entire transition so you can start building business credit immediately. First, we obtain the corporation’s EIN (Employer Identification Number) and officially transfer ownership into your name. We then provide you with a virtual business address and set up mail forwarding so you can begin receiving credit offers and official correspondence in your company’s name. From there, we guide you through our Funding Readiness Checklist, which may include securing collateral if required by lenders. We offer collateral options of $100,000 for $5,000 or $1,000,000 for $10,000 — and these collateral payments can be made by credit card if needed. Once you meet the checklist requirements, we submit your funding applications, and after you receive funding, our partner company Blue Revenue collects a 10% success fee of the funded amount. Even after the funding process is complete, our support doesn’t stop — we provide free credit repair services and assist you in applying for any business grants that become available. Payment for your shelf corporation can be made by money order, check, Cash App, Venmo, Zelle, or ACH transfer, making the process fast and convenient.

What costs are associated with the Shelf Corporation?

At Luxu Solutions, our aged shelf corporations are available for a flat fee of $2,500. This one-time investment includes full ownership transfer into your name, an EIN (Employer Identification Number), a virtual business address with mail forwarding, and our Funding Readiness Checklist to prepare you for capital acquisition. You’ll also receive expert guidance on building business credit, establishing bank relationships, and positioning your new corporation for funding approvals. Payment for your shelf corporation can be made via money order, check, Cash App, Venmo, Zelle, or ACH transfer, verify with us which one you prefer.

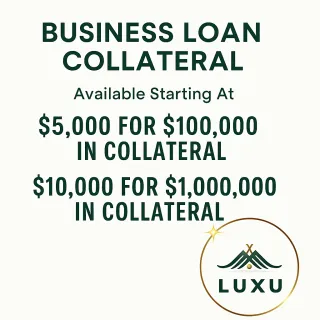

What if I need Collateral?

For clients who need it, we also offer collateral options starting at $5,000 for $100,000 in funding or $10,000 for $1,000,000 in funding, Payment for your collateral can be made via money order, check, Cash App, Venmo, Zelle, or ACH transfer, and ONLY collateral can be paid by credit card if preferred.

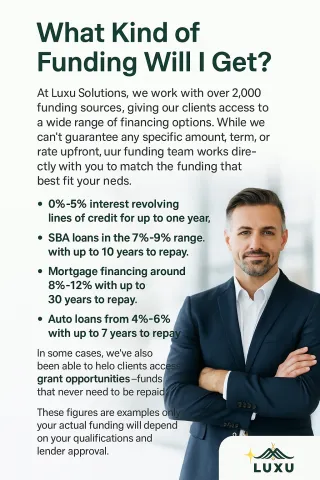

What type of funding will I get, and what about interest rates?

At Luxu Solutions, we work with over 2,000 funding sources, giving our clients access to a wide range of potential financing options. While we can’t guarantee any specific amount, term, or rate upfront, we always start by exploring SBA programs for the most competitive interest rates. Our funding team will then work directly with you to help secure terms that best fit your needs. Examples of what clients have received in the past include: 0%–5% interest revolving lines of credit for up to one year, SBA loans in the 7%–9% range with up to 10 years to repay, mortgage financing around 8%–12% with up to 30 years to repay, and auto loans from 4%–6% with up to 7 years to repay. In some cases, we’ve also been able to help clients access grant opportunities — funds that never need to be repaid. These figures are examples only; your actual funding will depend on your qualifications and lender approval. Our goal is to connect you with the best available options and guide you every step of the way.

Why use Shelf Corporations?

What is a Shelf Corporation and Why Use One?

📌 What is a Shelf Corporation?

A legally registered business that was created in the past but has never been used for operations.

Maintained in good standing with the state and aged over time (“sitting on the shelf”).

Comes with no debt, no liabilities, and a clean record.

📌 Why Use a Shelf Corporation?

Instant credibility with lenders, vendors, and clients.

Skip the 2+ year waiting period required for many traditional loans.

Qualify for larger credit lines and better financing terms.

Separate funding from personal credit to protect your personal assets.

Access opportunities like government contracts and vendor accounts sooner.

Perfect for startups, entrepreneurs, and expanding businesses needing to accelerate growth.

Who Should Consider a Shelf Corporation — and When?

📊 Shelf Corporation vs. Starting Fresh — Which is Right for You?

✅ Choose a Shelf Corporation if:

You need instant business credibility with lenders & vendors.

You want fast access to $100K–$5M in funding.

You don’t yet meet traditional funding requirements (700+ credit score, 2+ years in business, $10K/mo revenue).

You want to separate funding from your personal credit.

You’re launching a new venture but need to skip the startup waiting period.

✅ Start Fresh if:

You’re not ready to apply for funding yet.

You want to grow organically over time and build your own credit history.

Your business is highly specialized and benefits from full control of branding and setup from day one.

You already meet traditional lending requirements and don’t need the aged history boost.

📋 What Happens After You Purchase Your Shelf Corporation?

1️⃣ Ownership Transfer & EIN

We get your corporation’s EIN and officially transfer ownership into your name.

2️⃣ Business Address & Mail Forwarding

We set up your virtual business address and forward all mail so you can start receiving credit offers.

3️⃣ Funding Readiness Checklist

We walk you through every requirement to get funded (may include collateral).

4️⃣ Collateral Options (If Needed)

$100K collateral = $5,000

$1M collateral = $10,000

Collateral can be paid by credit card.

5️⃣ Funding Application & Approval

We submit your applications and secure $100K–$5M in funding.

6️⃣ Success Fee

After you’re funded, our partner Blue Revenue collects 10% of the funded amount.

7️⃣ Ongoing Support

Free credit repair for your business.

Assistance applying for grants when available.

💳 Payment Methods:

Shelf corp ($2,500) can be paid by money order, check, Cash App, Venmo, Zelle, or ACH transfer.

Collateral can be paid by credit card if needed.

Our program works with a team of advisors to not only show you how to borrow funding for your business, but also how to deploy those resources appropriately to run a cash-flowing business.

What Kind Of Funding Can I Get?

SBA Loan

Unique Benefits

5-30 year terms

Government-backed funds

Refinance existing business debt

Can be entirely written off as tax paymentsNational U.S. Grants

Unique Benefits

Do not need to be paid back

No minimum credit score

2,000+ Grants currently available

$100,000+ in grant funding available

Investment Capital

Unique Benefits

Do not need to be paid back

No minimum credit score

No collateral required

Licensed and regulated investors

Combining debt and equity allows your business to access $250,000-$10M (Must be US Citizen, have a small business, and in a non-speculative industry).

Lines of Credit

Unique Benefits

6-24 Month Terms Available

Weekly or monthly payments

Same-day funding up to 250K

True Revolving lineAccount Receivable Financing

Unique Benefits

Lowest cost

Longer terms

Larger amounts

Revolving line of Credit

Equipment Financing

Unique Benefits

3-7 Year terms

Fixed rates start at 6%

Monthly Payments

Can be entirely written off as tax paymentsReal estate

Unique Benefits

40-year mortgage

Fix and flip

New Construction

Long short-term rental

Multi-family

Don't worry, we can help!

DISCLOSURE AND OTHER NOTICES:

Nothing on this web page should be considered as any type of earnings claim (implied or otherwise). We can't predict the future so we can't tell you what a "typical" or “average” result would be. What we do know is the vast and overwhelming majority of people who take classes about business don't get any results at all. Similar to the way most people who buy exercise equipment don't look like the people in the commercials. We only offer education intended to help individuals and business owners learn our method for business funding that can become a profitable business deal. It is NOT a "business opportunity". If you choose to pursue this education it will require work, commitment and most importantly perseverance. So get ready to put in the work and stick it out. If you're not committed, I'd advise you to pass on this.

DISCLAIMER: The figures and results mentioned on this page reflect our personal experiences or, in some cases, the experiences of our clients. These results are not typical and should not be interpreted as guarantees of success. We make no claims or assurances that you will achieve the same results—or any results—by purchasing or using our products or services. Individual results will vary significantly based on numerous factors, including but not limited to your background, experience, skills, work ethic, and the effort you put into applying the information provided. The majority of individuals who purchase "how-to" information fail to achieve significant results. We provide examples strictly for illustrative purposes only.

NO GUARANTEE OF RESULTS: National Business Access Initiative does not guarantee any specific outcomes or financial success from using our courses, products, or services. Past performance is not indicative of future results.

RISKS INVOLVED: All business ventures involve inherent risks, including potential financial loss. Success requires substantial effort, consistency, and action. If you are not prepared to accept these risks and commit to the necessary effort, please do not purchase any National Business Access Initiative products or services.

LIMITATION OF LIABILITY: National Business Access Initiative and its affiliates shall not be held liable for any direct, indirect, incidental, or consequential damages arising from your participation in our courses, use of our products, or reliance on the information provided.

GOVERNING LAW & JUISDICTION: This disclaimer, along with any disputes arising from your use of National Business Access Initiative products or services, shall be governed by the laws of the State of TEXAS, without regard to its conflict of law provisions. Any legal claims or actions shall be resolved exclusively in the courts located in TEXAS.

ACKNOWLEDGMENT: By purchasing any National Business Access Initiative product or service, you confirm that you have read, understood, and agreed to this disclaimer. You acknowledge that you are solely responsible for your success and any outcomes resulting from your participation in our programs.

FTC DISCLOSURE: This page complies with all applicable advertising regulations, including the Federal Trade Commission (FTC) guidelines concerning earnings claims. All examples and testimonials provided are truthful and documented, and individual results are not guaranteed.

CONTACT INFORMATION: For any questions or concerns regarding this disclaimer or National Business Access Initiative policies, please contact us at [email protected]

All rights reserved. This is not an offer to enter into an agreement. Information and programs are subject to change without notice.

LUXU Solutions

(619) 558-2388

custom_values.company_logo=https://storage.googleapis.com/msgsndr/jqvYfqhB03wXWl1NyvNP/media/683093ef6417b20ba0758ecd.png

custom_values.headshot=https://storage.googleapis.com/msgsndr/jqvYfqhB03wXWl1NyvNP/media/683093ef6417b20ba0758ecd.png